Table of Content

This is also a good loan if you don't have a credit score, as non-traditional forms of credit are accepted. You can buy or refinance your home with an FHA loan ; eligible property types include stick built, condos, modular and manufactured homes. If all else fails, a personal loan is also a financing option for your manufactured or mobile home.

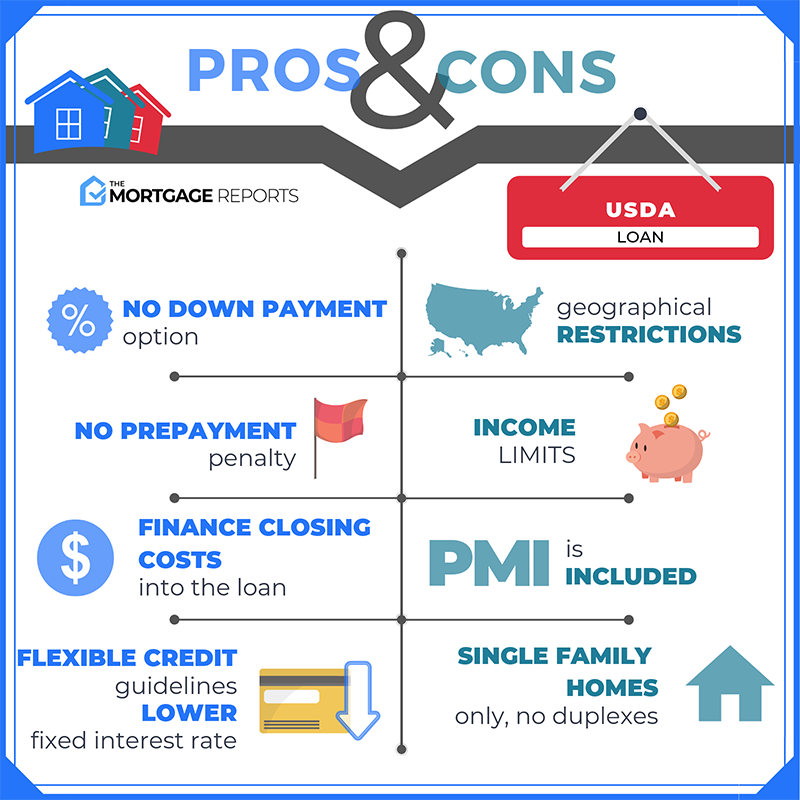

These homes are built in a factory setting under very intense control according to the HUD code. To qualify for low mobile home interest rates, make sure your credit score is at least 700. You’ll need a score of 750 or higher to qualify for the best rates available. And unlike traditional mortgages, you can be disqualified for making too much money. The maximum limit is 115% of the median income for the county or area you want to live in.

Types Of Loans For Mobile Or Manufactured Homes

If you meet the credit and borrower requirements, you may be able to use an FHA loan to finance the home and the land on which it will sit. It’s best to have a credit score of at least 580 before applying for manufactured home financing. Borrowers with credit scores of 620 or higher have more loan options. Personal loans may require higher scores since they’re not secured or insured.

The average cost per square foot for a new manufactured home in the United States is $72.21 as of 2021, according to data from the U.S. However, manufactured home costs vary by location and size of the home, so expect to find a broad range in prices. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Manufactured housing is a home unit constructed primarily or entirely off-site prior to being moved to a piece of property where it is set. Manufactured homes account for 6% of all occupied housing but a much smaller percentage of home loan originations, according to a report issued by the Consumer Financial Protection Bureau .

What Is the Down Payment Required to Buy Land?

In spite of skyrocketing mortgage rates, average home prices are still increasing by double digits year over year. Mortgage loan interest rates after bankruptcy may range from low to high, depending on the loan amount and the borrower’s credit. Your credit score may drop by as much as 200 points if you declare bankruptcy. Chapter 13 entails reorganizing your debts rather than wiping them out entirely. It’s possible that you’ll have to start making regular payments to your debtors.

As a result, borrowers have found it challenging to find manufactured home financing in recent years, which has left many seeking a private loan or buying a regular home. When compared to their conventional counterparts, site-built homes, mobile and manufactured homes are certainly more cost-effective. As a result, buying a trailer home rather than a regular home can save you up to 30% on your housing costs. While it’s not always required, you may also want to think about saving for a down payment on your manufactured or mobile home.

How Long After Bankruptcy Can I Get a Conventional Loan

These types of dwellings may make good starter homes for individuals and families who may not be able to afford a larger mortgage. The loans come with 30-year financing, and you may be able to secure them with a down payment as low as 3 percent. As an added benefit, interest rates on MH Advantage mortgages tend to be lower than those of most traditional loans for manufactured homes. Many lenders are hesitant to issue VA mobile home mortgages for a variety of reasons, including declining house values and an increased chance of homeowners defaulting on their loans.

He also can balance a checkbook and keep track of investments with Quicken quite adeptly. McManamon’s experience includes covering the NFL for ESPN, LeBron James for the Akron Beacon Journal and AOL Fanhouse, and the Florida Gators and Miami Hurricanes for the Palm Beach Post. The average national price of a new manufactured home is $81,700, while the average national price of a new site-built home sold in 2020 was $287,465, according to the HomeAdvisor.com. Nonprofits like InCharge Housing Counseling havecredit counselorswho work to improve your credit and find out if you qualify for down payment assistance. Check with your bank or credit union to see if they can help you with a USDA loan application for a manufactured loan. A factory-built home built after June 15, 1976, is a manufactured home.

The U.S. Department of Housing and Urban Development keeps a list of active programs by state. If you’ve ever been stuck in traffic behind what looks like a house cut in half, then you’ve seen a modular home. Modular homes are still homes that are manufactured in other places and then assembled on site.

Factory-line assembly also means manufactured houses can be built to scale, which drives down the cost of materials and labor. Property taxes on manufactured homes are also lower thanks to their smaller size and value. The cost of a manufactured home is determined by several factors, including its size, location, and age. Double-wide manufactured homes cost around twice as much as single-wide homes, homes in urban and suburban areas cost more than rural homes, and newer homes cost more than older homes. In addition, a manufactured home mortgage that covers the property and the surrounding land will understandably cost more than a loan for just the property itself. FHA Mobile Home Guidelines A typical mobile home is built in a factory and may come as a single wide, double wide or triple wide version.

Not all borrowers will qualify; contact us for more information on fees and terms. If you have less-than-perfect credit and are looking for a loan with a lower down payment, an FHA loan - backed by the Federal Housing Administration - may be the answer. Before you can move in, you’ll need to insure the home and fulfill any other occupancy and maintenance requirements to avoid potential problems or delays. In 2021, the average manufactured home price was $108,100, but a single-family home cost an average of $365,904 . You may be able to finance some of these costs along with the home.

What you call a mobile home is probably a manufactured home, even though the home isor once wasmobile. Either term works, but most lenders avoid lending on properties that are categorized as mobile homes. Typically, it’s easier to get a traditional mortgage on a modular home compared to getting a mobile home loan. Fireengineering.com states that “In mobile homes built before 1976, heating and cooking equipment are in close proximity to sleeping areas.

No comments:

Post a Comment